Copay Card Impact Calculator

Input Your Medication Costs

Important Information

This calculator shows how copay cards affect your deductible progress. Remember:

- Most copay cards only work for privately insured patients

- Insurance companies often don't count card payments toward your deductible

- When your card expires, you may owe thousands in unexpected costs

Your Deductible Impact

Your Monthly Out-of-Pocket

Deductible Progress (Your Perspective)

Deductible Progress (Insurance Perspective)

When you’re managing a chronic condition like multiple sclerosis, rheumatoid arthritis, or Crohn’s disease, your medication isn’t just a pill-it’s your lifeline. For many, that lifeline comes with a price tag of $5,000 to $10,000 a month. That’s where copay cards come in. These cards, offered by drug manufacturers, promise to slash your out-of-pocket costs to $5 or $10 per prescription. But here’s the catch: what looks like a lifesaver can turn into a trap if you don’t know how they really work.

What Copay Cards Actually Do

Copay cards are not insurance. They’re financial assistance programs created by pharmaceutical companies to help commercially insured patients afford specialty drugs. When you hand your card to the pharmacist along with your insurance, the manufacturer pays part of your copay-sometimes $500, sometimes $1,000-so you pay less upfront. This system has helped 93% of users stick to their treatment, according to a 2023 NIH study. For many, it’s the only reason they can afford their medication at all.

But there’s a big limitation: these cards only work for people with private insurance. If you’re on Medicare, Medicaid, or any government plan, you’re automatically excluded. That’s because federal law bans drug makers from directly subsidizing public programs to avoid kickback violations. So if you’re on Medicare, this entire system doesn’t apply to you.

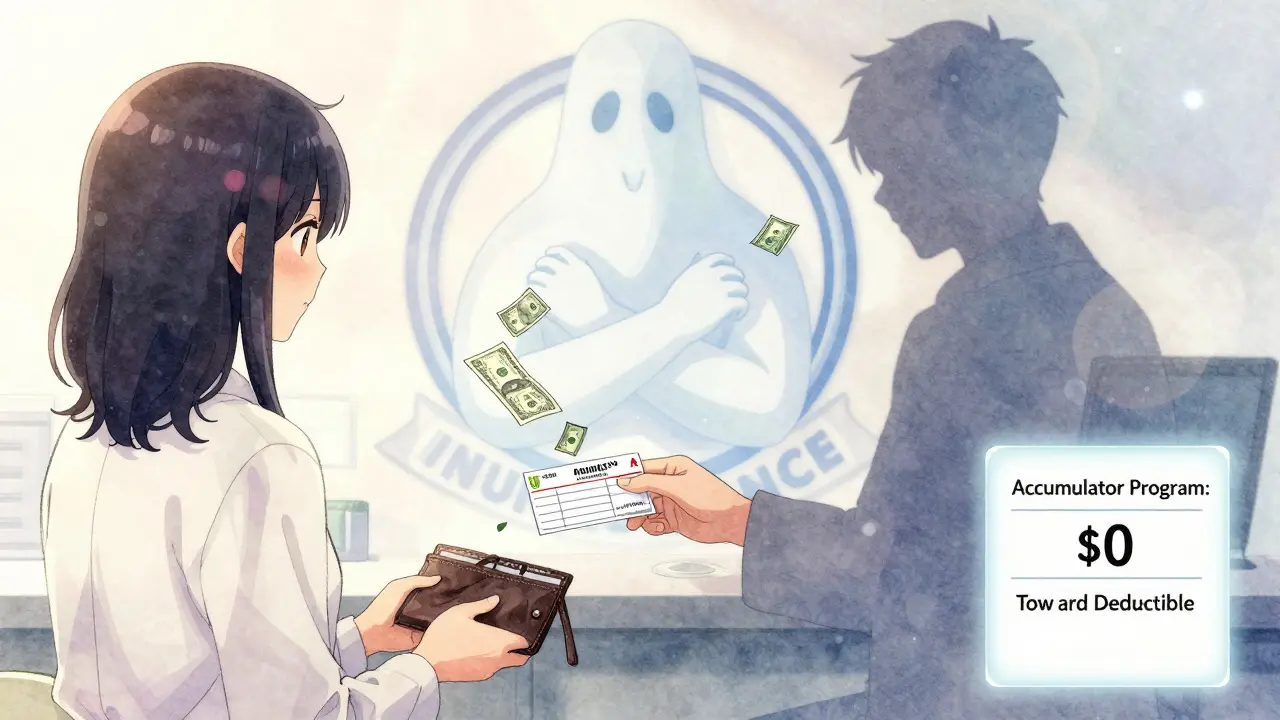

The Hidden Trap: Copay Accumulator Programs

The real danger isn’t the card itself-it’s what your insurance plan does with it. Since 2016, more than 78% of large commercial insurers have started using something called a copay accumulator program. Here’s how it works: when your manufacturer pays $1,000 toward your copay, your insurance doesn’t count that money toward your deductible or out-of-pocket maximum. That means even though you’re paying $0 out of pocket each month thanks to the card, your deductible stays at $7,000. Every dollar you spent last year? It doesn’t count.

Imagine this: You’re on a plan with a $7,000 deductible and an $8,000 out-of-pocket maximum. You’ve been using a copay card for two years. Your monthly drug cost is $7,500. The card covers $7,490. You pay $10. Your insurance sees $10 as your payment. After two years, you’ve paid $120 total. But your deductible? Still $7,000. When your card runs out-because most have annual limits-you suddenly owe $7,000. No one warned you. You panic. You skip doses. You stop treatment.

That’s not hypothetical. A patient on the National MS Society forum shared: “My $7,500 monthly medication became $10 after using the copay card for two years. When it expired, I discovered my $7,000 deductible was still untouched. I had to stop treatment for three months.”

Copay Maximizers: The Other Hidden Risk

Some insurers don’t just ignore the card-they manipulate it. That’s called a copay maximizer program. It’s used by 42% of large insurers. Here’s how it works: the insurer figures out the maximum amount the manufacturer will pay each month and sets your copay to exactly that amount. So if the card covers $1,000, you pay $1,000-even if your drug costs $10,000. You don’t pay $0. You pay $1,000. But here’s the twist: your insurer still doesn’t count that $1,000 toward your deductible. So you’re paying more each month, and still making zero progress toward your out-of-pocket maximum.

Why do insurers do this? Because it makes your drug look cheaper to them. They pay less per prescription, and the manufacturer covers the rest. But you’re stuck paying more each month, and you’re still not closer to coverage. The Specialty Pharmacy Journal found that maximizer programs can increase total annual drug spending for insurers by nearly 19% compared to accumulators-yet they’re still being pushed because they look good on paper.

Who’s Affected Most?

If you’re on long-term therapy-like biologics for autoimmune diseases, cancer treatments, or rare disorders-you’re at highest risk. The average patient on these drugs takes 4.2 months to even realize their card isn’t helping their deductible. By then, it’s too late. Many patients don’t find out until their card expires and they get hit with a $5,000 bill.

Studies show that patients under accumulator programs are 23.4% more likely to stop their medication entirely. That’s not just inconvenient-it’s dangerous. For someone with MS, stopping treatment can mean losing mobility. For someone with Crohn’s, it can mean emergency surgery. The American Medical Association officially opposes these programs because they directly harm patient health.

How to Protect Yourself

You can’t avoid copay cards if you need them. But you can avoid the trap. Here’s what to do:

- Ask your pharmacist: “Does my plan have a copay accumulator or maximizer program?” Don’t assume. Ask every time you get a new prescription.

- Call your insurer: Request a copy of your benefits summary. Look for terms like “copay assistance does not count toward deductible” or “manufacturer payments excluded from out-of-pocket maximum.”

- Track your progress: Keep a log of how much you’ve paid out of pocket each month. If your card covers $1,000 and you pay $10, but your deductible hasn’t moved in six months-you’re in an accumulator program.

- Plan ahead: If your card expires in six months, start asking now: “What happens when this runs out?” Ask if your insurer offers any transitional assistance. Some pharmacies now send alerts when you’ve used 80% of your card-giving you time to prepare.

- Check for alternatives: Some manufacturers now offer “accumulator-resistant” programs that provide direct financial aid after your card expires. Ask your doctor or specialty pharmacy if these exist for your drug.

What’s Changing in 2026

There’s some good news. Starting January 1, 2026, the Department of Health and Human Services requires insurers to clearly disclose whether they use accumulator or maximizer programs during enrollment. They also have to send monthly statements showing your true progress toward your deductible-no matter what the card says. That means you’ll know exactly where you stand.

CVS Caremark is already rolling out transparency dashboards for patients, showing real-time deductible progress. But right now, only 28% of commercially insured Americans are covered by this change. The rest? Still flying blind.

Meanwhile, Congress is debating the Copay Accumulator Moratorium Act, which would ban these programs for three years. With 72 bipartisan co-sponsors, it has real momentum. But drug companies have spent nearly $29 million lobbying against it in early 2024. The fight isn’t over.

What You Need to Remember

Copay cards aren’t evil. They’ve kept thousands of people alive. But they’re not a permanent solution. They’re a temporary bridge-and if your insurance is actively blocking you from crossing it, you’re in danger. The system was built to help you. But the rules changed. And if you don’t know how, you’ll get left behind.

Know your plan. Ask the hard questions. Track your numbers. Don’t wait until the card runs out to find out you’ve been paying for nothing.

Can I use a copay card if I’m on Medicare or Medicaid?

No. Federal law prohibits drug manufacturers from providing copay assistance to patients enrolled in Medicare, Medicaid, or any other government-funded health program. This is to prevent violations of anti-kickback statutes. If you’re on Medicare or Medicaid and need help affording medication, you may qualify for patient assistance programs offered directly by manufacturers or nonprofit organizations, but these are separate from copay cards.

How do I know if my insurance has a copay accumulator program?

Call your insurance company and ask directly: “Do you use a copay accumulator program for specialty medications?” Look for phrases like “manufacturer payments do not count toward deductible” or “out-of-pocket maximum is not reduced by copay assistance.” You can also request a copy of your Summary of Benefits and Coverage (SBC)-it should mention this if it applies. Many insurers hide this info in fine print, so asking is the only reliable way to know.

What happens when my copay card expires?

If your plan has an accumulator program, your full drug cost will suddenly become your responsibility-because none of the manufacturer’s payments counted toward your deductible. For example, if your drug costs $8,000 a month and your deductible is $7,000, you’ll owe the full $7,000 in one month. If you have a maximizer program, you’ll pay the maximum allowed by the card each month (say $1,000) but still make no progress toward your out-of-pocket maximum. Either way, you’ll face a massive bill unless you’ve planned ahead.

Can I switch to a different insurance plan to avoid these programs?

You can only switch during open enrollment or if you have a qualifying life event-like losing coverage, getting married, or having a baby. If you’re currently covered through an employer, you’re likely locked in until next year. Some employers offer plans without accumulator programs, but they’re rare. If you’re shopping for insurance, always ask about copay assistance policies before choosing a plan. Plans with lower premiums often have the strictest accumulator rules.

Are there alternatives to copay cards if I’m stuck in an accumulator program?

Yes. Many drug manufacturers now offer “accumulator-resistant” assistance programs that kick in after your card expires-like direct grants, monthly vouchers, or nonprofit partnerships. Specialty pharmacies and patient advocacy groups (like the National MS Society or Crohn’s & Colitis Foundation) can help you apply. Some hospitals have financial aid programs. Don’t wait until you can’t afford your meds-start exploring options as soon as you learn you’re in an accumulator program.

What to Do Next

If you’re using a copay card right now, don’t wait. Today, call your pharmacy or insurer. Ask: “Does my plan use an accumulator or maximizer program?” Write down the answer. Check your last three statements. Has your deductible moved? If not, you’re being misled. Start planning now. Talk to your doctor. Reach out to patient support groups. Find out what happens when your card ends. The system is rigged. But knowledge? That’s power.

So let me get this straight. Pharma gives you a card to pay $10 so they can avoid paying Medicare. Insurance lets you think you're getting help but secretly ignores it so you hit your deductible later. And Congress is still debating this? We're literally punishing sick people for needing medicine. This isn't healthcare. It's a financial trap with a smiley face.

I just found out my plan has an accumulator program and I’ve been using my copay card for 18 months 😭 I thought I was saving money but my deductible is still at $7k. I’m so mad right now. I’m calling my insurer tomorrow and asking for a copy of my SBC. If anyone else is in this boat, PLEASE reach out. We need to band together.

LMAO so the system is designed to make you think you’re getting help while quietly setting you up for a financial gut punch 💀

And the worst part? You don’t even know until it’s too late. I’ve got a friend on Humira who just got hit with a $12k bill after her card expired. She cried for three days. This isn’t a glitch. It’s a feature.

You people are being way too nice. This isn't just unethical - it's criminal. Drug companies are using these cards to manipulate the system so they can charge $10,000/month and still look like heroes. And insurers? They're basically saying 'We'll let you pay $10 but we're not counting it' - that's not insurance, that's psychological warfare. Someone needs to sue these companies into oblivion.

I’ve been on a copay card for 3 years. I didn’t even know about accumulators until last month. I’m lucky I caught it before my card expired. I’m now in touch with my specialty pharmacy - they sent me a form to apply for direct financial aid. It’s not perfect, but it’s something. If you’re reading this and you’re on a card - don’t wait. Ask. Now. Don’t trust the silence.

The structural inequities embedded within the American healthcare financing apparatus are both profound and deliberately obfuscated. The utilization of copay accumulator and maximizer mechanisms constitutes a form of institutionalized harm, particularly toward chronically ill populations reliant upon specialty pharmaceuticals. The moral imperative to reform these practices cannot be overstated.

So you paid $10 for 2 years and now owe $7k. Got it. You should’ve read the fine print.

I’m so glad this article exists. I’ve been telling everyone I know about this for months. It’s not just about money - it’s about trust. When you’re sick, you rely on your pharmacy, your insurer, your doctor. And if they’re hiding this? That’s betrayal. I’m sharing this with my support group tonight. We’re all in this together.

Also, the fact that Medicare patients are completely cut out? That’s pure discrimination. If you’re poor enough to need government help, you don’t get help. Classic. The rich get cards. The sick get bills.

Hey everyone - I work at a specialty pharmacy in Mumbai and we’ve seen this happen globally. In India, patients face similar traps with private insurers. The good news? Patient advocacy groups are pushing for transparency. You’re not alone. Reach out to your local MS or Crohn’s org - they’ve got resources. I’ve helped 12 patients this month get direct aid. You can too.

Just got off the phone with my insurer. They said my plan has a maximizer program. I’m paying $1,000/month now - but my deductible is still at $7k. I asked if they’d consider a transitional program. They said they’d ‘review my case.’ Translation: no. I’m applying for nonprofit aid tomorrow. This system is broken. But I’m not giving up.